Heathrow airport is one of the busiest international airports in the world with 75m passengers in 2016. As one of the top two European gateway entry points for Chinese tourists, it has to cope with a significant bottleneck with sales (VAT) tax refund requests. These requests by a large volume of passengers require administration and processing at point of departure. Traditionally, VAT refund is a complex, time consuming offline paper-based process, requiring detailed form filling and exact corroboration with extensive, specific records and documented evidence of purchases, via a series of participating services providers.

The ACTTAO WeChat Travel & Tourism Platform for Online VAT Refund Services and Retailing

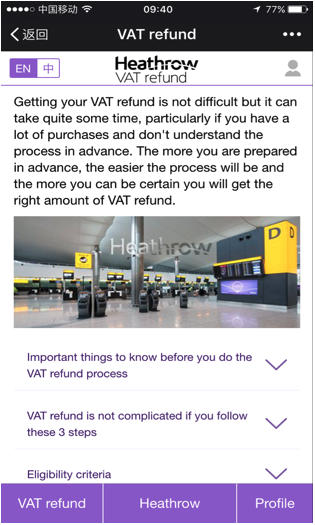

ACTTAO designed and developed the Heathrow VAT refund platform as a mobile companion app and browser-accessible website that is integrated with WeChat. Its designed for Chinese tourists visiting the UK to manage their sales tax refund process using an O2O (Online-Offline) services model while also offering them a range of digital features including traveler information, retail services and promotional marketing offers. The platform leverages the WeChat Official Account (OA) structure with an integrated HTML5 microsite to provide a dedicated 'chat' based mobile retailing and services channel.

Built for HAL (Heathrow Airport Ltd) by ACTTAO after the original contractor, IBM, declined the project, the platform incorporates interactive customer services functions, as well as information on the most efficient process for applying for the refunds available to each tourist.

In addition, there are a range of features that provide traveller advisory services, incentives and special offers, tourist information on London and shopping incentives in Heathrow’s tax-free retail facilities.

Traditional Tax Refund Processing

- Travel to UK

- Shopping in UK

- Filling tax refund forms

- Prepare to get tax refund

- Go to the airport

- Get your tax refund

- Shopping in duty free shops

How the Online Heathrow VAT Refund Services Improve the User Experience

- Avail of travel info, travel advice, tourist coupons, special offers and services

- Browse tourist information and regulations on the UK VAT refund process

- Check the tax refund process with easy to follow visual cues and content

- Manage your own tax refund process to suit your shopping trip

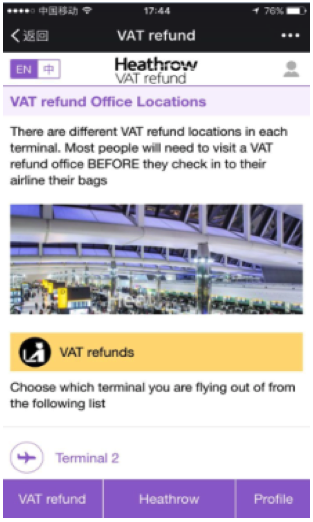

- Access airport location maps and on-site VAT refund provider information

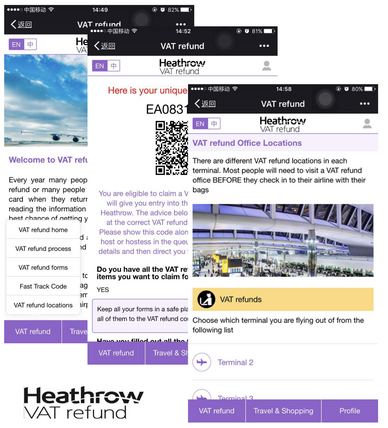

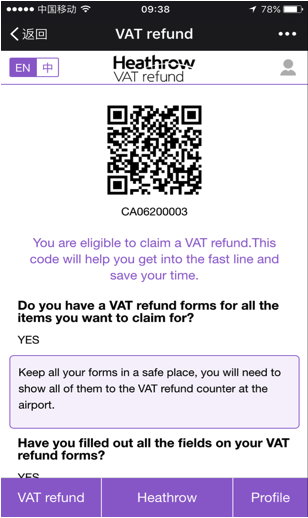

- Secure a unique fast track code to save up to 50% of the time queuing for VAT refunds

- Redeem coupons and customized services for airport duty-free shopping

ACTTAO VAT Refund Platform Benefits Chinese WeChat Users

Location check. Each terminal has multiple VAT refund counters, users can find the nearest counter through geolocation.

Travel service. Providing special offers for VAT refund users such as mobile sim cards, hotels, public transportation services.

Online shopping. eStores support the trend of "shop&collect" for travellers who transit through major airports such as Heathrow.

Fast track queue. Giving users advice based on their flight times and departure gate access, fast track codes to get refunds in time.

Refund guide. Detailed VAT refund advice with interactive content, how-to guides, minimizing problems encountered in the refund process.

VAT refund location check

VAT refund travel service

VAT refund online shopping

VAT refund fast track queue