With over USD $900 Billion in sales in the e-commerce market, Asia is the largest e-commerce market worldwide. That's why we created this simple guide for you to understand how the Chinese e-commerce ecosystem works.

Let’s start by mentioning a couple of facts about Asia’s market:

-Asia’s market represents 47% of all global e-commerce sales

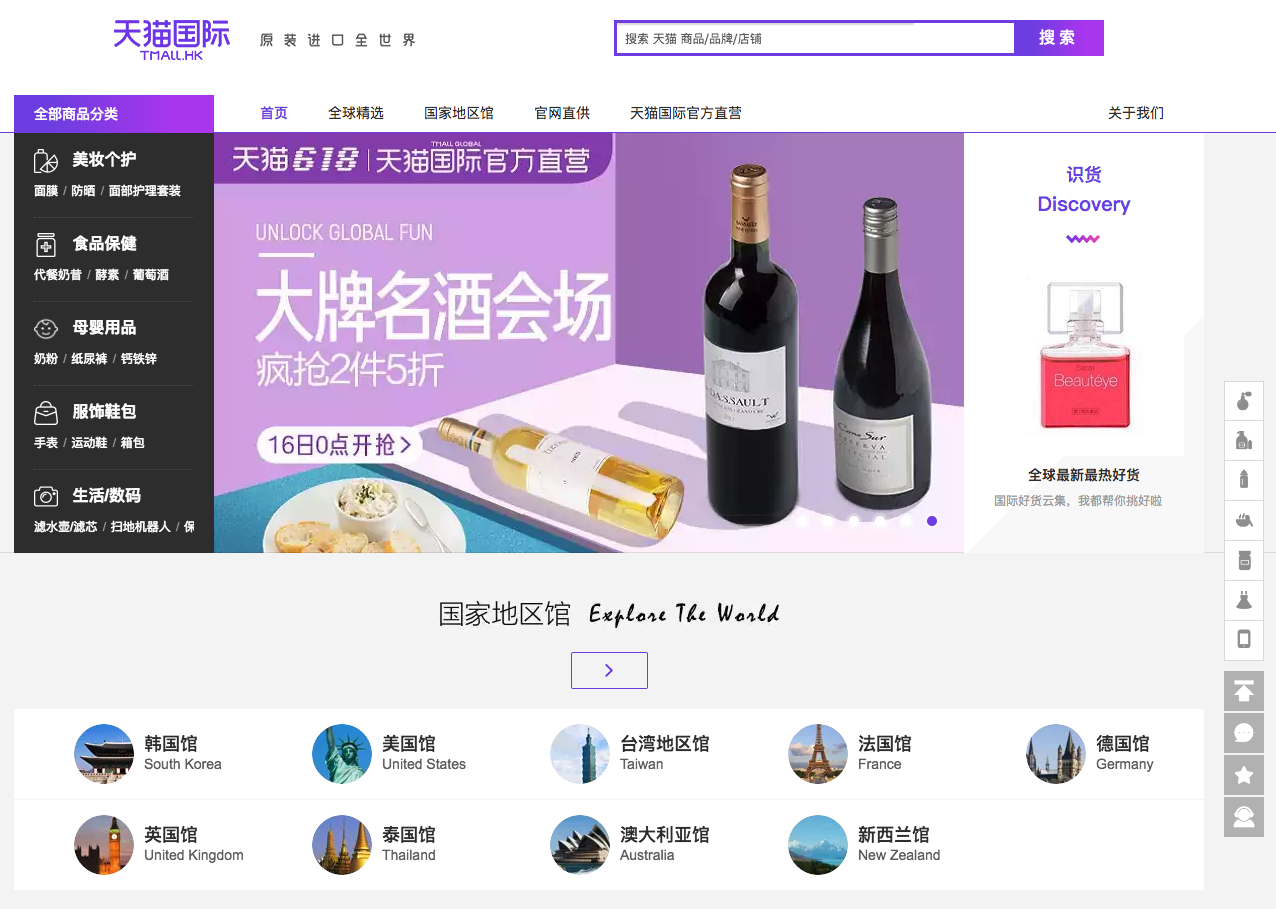

-Tmall and JD represent over 80% market share

-90% of the population from tier 1 cities are active on WeChat

-Asia’s online shopping population is about 437 Million

-60% of Internet users shop online in Asia

-20% of chinese consumers purchase goods abroad

A notable trend is the strong preference of many Chinese online shoppers to buy from overseas brands and retailers through cross-border online shopping - known as haitao or CBEC (cross-border E-commerce). Simply, it involves a Chinese consumer placing an order online with an overseas based online retailer, who imports the product into Asia.

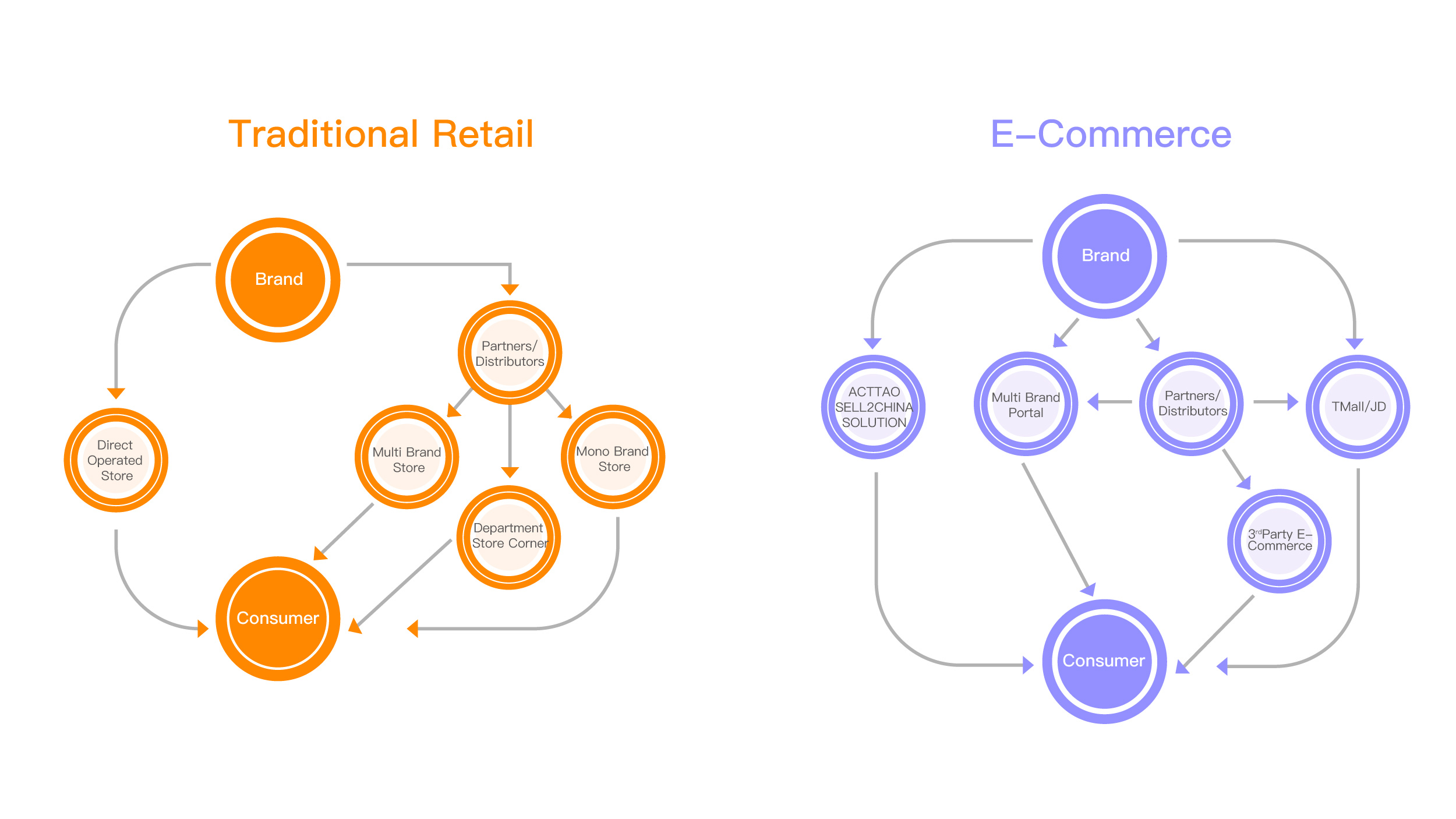

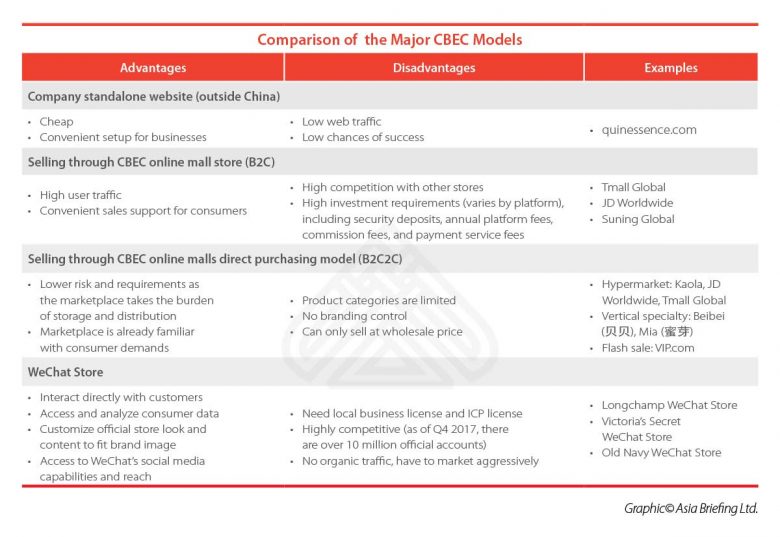

Typically, overseas brands and retailers have sold cross-border into Asia through online marketplaces offered by Asia’s E-commerce giants, such as Alibaba and JD.com. While this is the best-known model, there is no “one size fits all” approach for brands and retailers.

Now that you a know a little bit more about the growth and scale of the Chinese market, let’s review the routes to market by considering the main (3) channels through which a company can introduce their product with in this unique market.