- Localization & Digital Design

- Platform Management

- Online Distribution Operations

- Web & Channel Integration

- IT Support & Server Hosting

- Warehousing, Order Fulfilment & Logistics (3PL)

- Local Customer Support Services

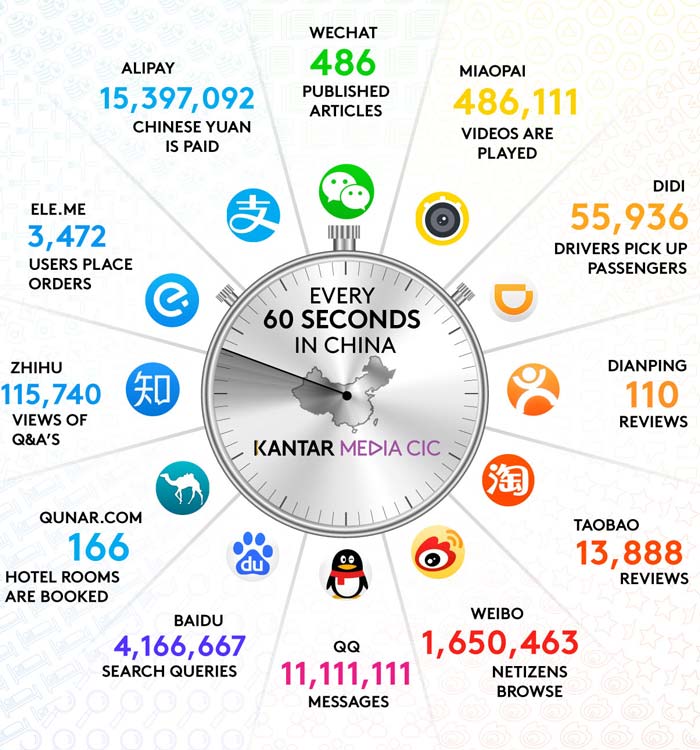

The average Chinese customer journey to the point of purchase incorporates up to 8 brand touch points which is twice the average of the UK or USA.

So selling in Asia is complex and great technology is only half the story.

It also demands a set of effective omnichannel trading partner (TP) services from your Cross Border eCommerce provider. This partner should be ideally able to deliver all the management skills essential to achieving an early sales ROI (Return on Investment).

Your customer in Asia may engage with your brand across different social media platforms and multiple ecommerce channels before showing any intent to follow, share, purchase and recommend.

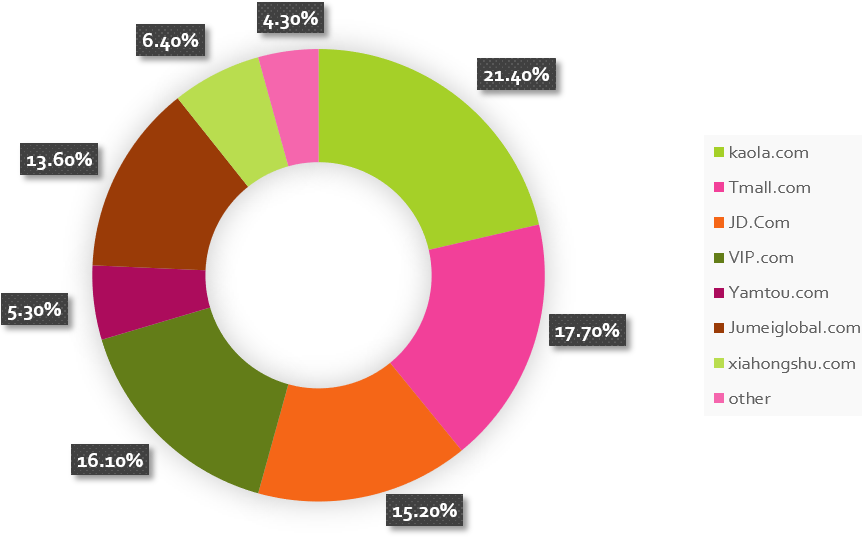

So Chinese cross-border ecommerce (CBeC) shoppers are looking beyond the de facto marketplaces, and are shopping on an expanding series of fast growing and innovative 3rd party ecommerce platforms and social e-commerce apps, as well as engaging through the brand owner’s standalone direct-to-consumer online store.

Additionally, there are the complexities involved in selling in Asia which mean the “one size fits all” approach of the Alibaba and JD marketplaces with their inherent costs and issues are no longer universally appropriate. They fail to meet many of the sales platform demands of brands other than perhaps individual category or sector leaders operating with global scale.

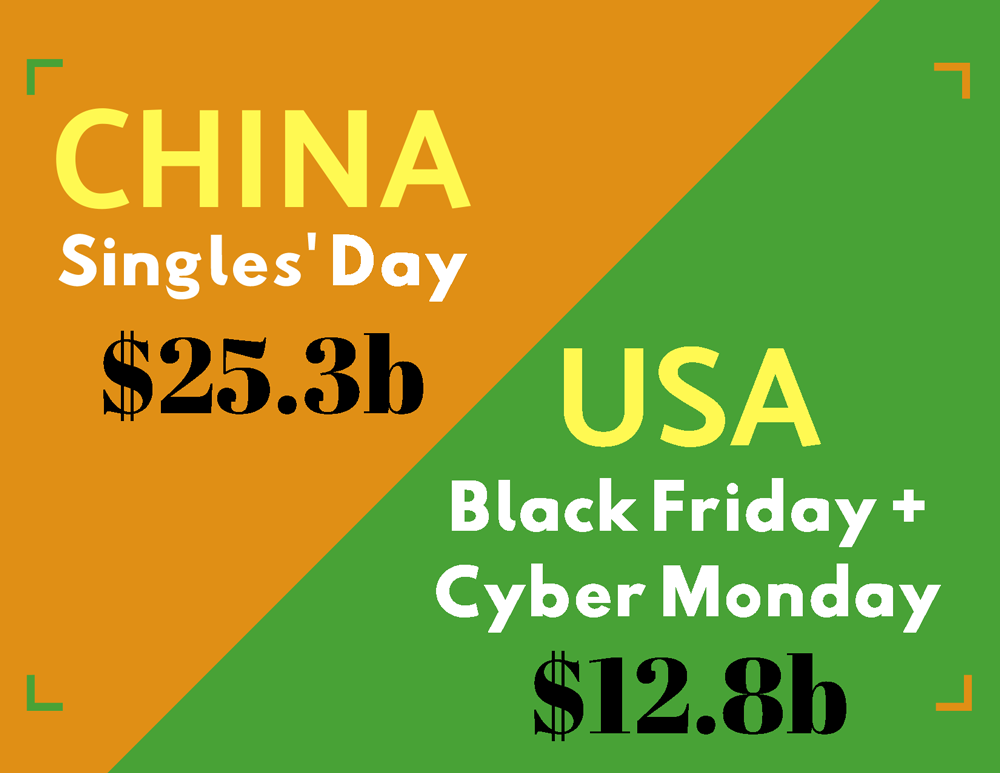

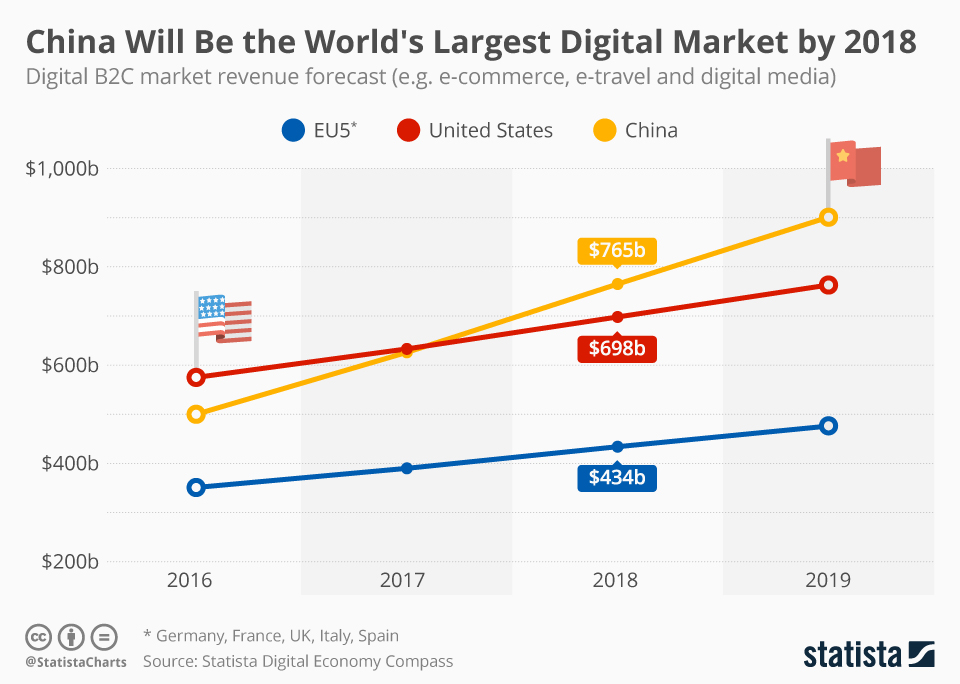

Asia will be the world's largest digital market by 2018

Asia will be the world's largest digital market by 2018

International merchants and brand recognise the need for them to secure a greater level of personal engagement with customers and the delivery of a more authentic online shopping experience. Many brands and retailers report not being satisfied with the B2C demand generation through the giant online marketplaces, with only 30% of online-only retailers scoring Chinese platforms such as Tmall and JD with high marks (Source: Frost & Sullivan).

Issues with the giant marketplaces such as high sales commissions, the drive to discounting, unofficial resellers being accommodated, rampant counterfeiting and infringement, and the lack of sustainable direct customer engagement are regularly highlighted.

As a result, overseas retailers, merchants and brand owners need to carefully determine how to build a cross-border, multi-channel Asia CBeC strategy over time that will work best for them.

ACTTAO offers management services and support for all the popular and emerging cross-border online marketplaces, social ecommerce platforms and mobile shopping apps, to deliver a successful omnichannel Asia business model.